Oliver Gliese net worth refers to the total value of the financial assets and liabilities owned by the German astrophysicist and astronomer Oliver Gliese. It encompasses his earnings, investments, and properties, minus any outstanding debts or obligations.

Determining an individual's net worth provides insights into their financial stability, success, and overall economic well-being. In the context of Oliver Gliese, his net worth serves as an indicator of his professional accomplishments and contributions to the field of astronomy.

The main article will delve into the details of Oliver Gliese's net worth, including his income sources, investment strategies, and any notable financial milestones or achievements. It will also explore the significance of his work in astronomy and its impact on our understanding of the universe.

Oliver Gliese Net Worth

Oliver Gliese's net worth, a reflection of his financial status, encompasses various dimensions that contribute to his overall economic well-being.

- Income sources: Salary, royalties, investments

- Investment strategies: Stocks, bonds, real estate

- Financial milestones: Major awards, grants, investments

- Tax implications: Income tax, capital gains tax

- Estate planning: Wills, trusts, beneficiaries

- Lifestyle expenses: Housing, transportation, travel

- Charitable giving: Donations, philanthropy

- Debt management: Loans, mortgages, credit cards

- Economic trends: Inflation, interest rates, market volatility

Understanding these key aspects provides a comprehensive view of Oliver Gliese's net worth and its implications for his financial security and overall well-being. For instance, his income sources shed light on his earning potential and career success, while his investment strategies reveal his approach to wealth management and risk tolerance. Furthermore, knowledge of his financial milestones highlights significant achievements that have contributed to his net worth growth.

Overall, Oliver Gliese's net worth serves as a valuable indicator of his financial status and achievements. It is a reflection of his hard work, dedication, and prudent financial management. By exploring the various dimensions related to his net worth, we gain a deeper understanding of his financial well-being and its impact on his life and career.

Personal Details and Bio Data of Oliver Gliese| Name: | Oliver Gliese ||---|---|| Born: | 29 January 1912 || Birth Place: | Berlin, Germany || Died: | 12 August 1993 || Occupation: | Astrophysicist, astronomer || Known for: | Gliese Catalogue of Nearby Stars, Gliese limit |Income sources

The income sources of an individual, including salary, royalties, and investments, play a pivotal role in determining their net worth. In the case of Oliver Gliese, these sources have contributed significantly to his overall financial status and economic well-being.

- Salary: As a renowned astrophysicist and astronomer, Oliver Gliese likely earned a substantial salary throughout his career. His contributions to the field, including the development of the Gliese Catalogue of Nearby Stars and the Gliese limit, would have commanded a significant income.

- Royalties: Gliese may have received royalties from the publication of his research papers, books, or other written works. These royalties represent a passive income stream that can continue to generate revenue over time.

- Investments: It is possible that Gliese invested a portion of his income in stocks, bonds, or real estate. These investments have the potential to generate returns in the form of dividends, interest, or capital appreciation, further contributing to his net worth.

The combination of salary, royalties, and investments has likely been instrumental in the growth of Oliver Gliese's net worth. These income sources have provided him with a steady stream of revenue, enabling him to accumulate wealth and achieve financial security.

Investment strategies

Investment strategies involving stocks, bonds, and real estate can significantly impact an individual's net worth, including that of Oliver Gliese. These investment vehicles offer varying levels of risk and return, and their allocation can greatly influence the overall financial portfolio.

Stocks represent ownership in a company and have the potential for high returns through capital appreciation and dividends. However, they also carry higher risk due to market volatility. Bonds, on the other hand, are loans made to companies or governments and typically offer lower returns but with less risk compared to stocks. Real estate involves investing in properties, which can generate rental income and appreciate in value over time. It is generally considered a less liquid investment compared to stocks and bonds.

Oliver Gliese's investment strategy likely involved a combination of these asset classes, tailored to his risk tolerance and financial goals. By diversifying his investments across different asset classes, he could potentially mitigate risk while maximizing returns. For instance, a portion of his portfolio may have been allocated to growth stocks for potential capital appreciation, while another portion may have been invested in bonds for stability and income generation. Additionally, real estate investments could have provided a hedge against inflation and a source of passive income.

Understanding the connection between investment strategies and net worth is crucial for individuals seeking to manage their wealth effectively. By carefully considering the risks and returns associated with different asset classes, investors can make informed decisions that align with their financial objectives and risk tolerance. This knowledge empowers individuals to grow their net worth and achieve long-term financial success.

Financial milestones

Financial milestones encompass significant achievements and events that contribute to an individual's net worth. In the context of Oliver Gliese, these milestones include major awards, grants, and investments that have played a pivotal role in shaping his financial status.

- Major awards: Recognition for scientific achievements, such as the Bruce Medal from the Astronomical Society of the Pacific, can bring not only prestige but also monetary rewards that contribute to net worth.

- Grants: Funding from organizations like the National Science Foundation or the European Research Council enables research projects and fosters scientific advancements, potentially leading to new discoveries and increased net worth through royalties or patents.

- Investments: Strategic investments in stocks, bonds, or real estate can generate substantial returns over time, significantly impacting net worth. Gliese's investments may have been influenced by his understanding of economic trends and market dynamics.

- Real estate: Owning properties can provide a steady stream of income through rent and potential capital appreciation, contributing to overall net worth.

These financial milestones serve as markers of Oliver Gliese's success and dedication to his field. They have not only enhanced his reputation but also contributed to his financial well-being, allowing him to pursue his research interests and make valuable contributions to astronomy.

Tax implications

Tax implications play a significant role in shaping Oliver Gliese's net worth. Understanding how income tax and capital gains tax affect his financial situation is crucial for assessing his overall economic well-being.

- Income tax: Income tax is levied on an individual's earnings, including salary, royalties, and investment income. The tax rate varies depending on the income bracket, and Gliese's income tax liability would have fluctuated based on his annual earnings.

- Capital gains tax: Capital gains tax is imposed on profits made from the sale of assets, such as stocks or real estate. Gliese's investment strategy would have been influenced by capital gains tax considerations, as he would have sought to maximize returns while minimizing tax implications.

Effective tax planning is essential for optimizing Oliver Gliese's net worth. By utilizing tax-advantaged investment vehicles, such as retirement accounts or tax-free bonds, he could potentially reduce his tax liability and preserve his wealth. Additionally, understanding the tax implications of different investment strategies allows Gliese to make informed decisions that align with his financial goals and tax situation.

Estate planning

Estate planning is a crucial aspect of financial management, as it ensures the orderly distribution of an individual's assets after their death. In the context of Oliver Gliese's net worth, estate planning plays a vital role in preserving and distributing his wealth according to his wishes.

- Wills: A will is a legal document that outlines an individual's wishes for the distribution of their property and assets after their death. Gliese's will would have specified the beneficiaries of his estate, including family members, friends, or charitable organizations.

- Trusts: A trust is a legal arrangement in which an individual (the settlor) transfers assets to a trustee, who manages and distributes those assets for the benefit of designated beneficiaries. Trusts can be used for various purposes, such as managing inheritance taxes, providing for dependents, or supporting charitable causes. It is possible that Gliese established trusts as part of his estate plan.

- Beneficiaries: Beneficiaries are individuals or entities who inherit assets from an estate. In Gliese's case, his beneficiaries would be those named in his will or designated as beneficiaries of his trusts. The distribution of assets to beneficiaries would depend on the specific terms of his estate plan.

Estate planning allows Oliver Gliese to exert control over the distribution of his net worth after his death, ensuring that his assets are managed and distributed according to his wishes. By creating a comprehensive estate plan, Gliese can provide financial security for his loved ones, minimize estate taxes, and support causes that are important to him, thus preserving his legacy and maximizing the impact of his net worth.

Lifestyle expenses

Lifestyle expenses encompass the costs associated with maintaining a certain standard of living, including housing, transportation, and travel. These expenses play a significant role in determining Oliver Gliese's net worth, as they directly impact his disposable income and overall financial well-being.

Housing, typically the most substantial lifestyle expense, includes mortgage payments or rent, property taxes, insurance, and maintenance costs. Gliese's choice of residence, whether a modest apartment or a luxurious mansion, would have a significant impact on his net worth. Similarly, transportation costs, including car payments, fuel, and insurance, can vary greatly depending on his lifestyle and preferences. Travel expenses, whether for business or leisure, can also be substantial, especially if Gliese enjoys frequent trips to distant destinations.

The connection between lifestyle expenses and net worth is evident in the fact that higher expenses reduce disposable income and, consequently, the potential for savings and investment. Conversely, individuals with lower lifestyle expenses have more financial flexibility and can allocate a larger portion of their income towards wealth accumulation. Understanding this relationship empowers individuals to make informed decisions about their spending habits and prioritize financial goals.

Charitable giving

The connection between charitable giving and Oliver Gliese's net worth lies in the impact it has on his financial resources and overall wealth management strategy. Charitable giving encompasses donations to organizations or causes that align with an individual's values and philanthropic goals.

- Tax implications: Charitable donations may be tax-deductible, reducing an individual's tax liability. This tax benefit can incentivize charitable giving, allowing donors to maximize the impact of their contributions.

- Estate planning: Charitable bequests, or donations made through a will or trust, can be an effective way to reduce estate taxes and ensure that a portion of an estate is directed towards causes the individual supports.

- Legacy and values: Charitable giving allows individuals to express their values and support causes they believe in, leaving a lasting legacy that extends beyond their lifetime.

- Financial planning: Charitable giving can be incorporated into an overall financial plan, ensuring that philanthropic goals are aligned with investment and retirement strategies.

Understanding the relationship between charitable giving and net worth is crucial for individuals seeking to align their financial resources with their values and make a positive impact on society. By considering the tax implications, estate planning opportunities, and personal values associated with charitable giving, individuals can make informed decisions that maximize the impact of their donations while also preserving their financial well-being.

Debt management

Debt management, encompassing loans, mortgages, and credit cards, plays a crucial role in shaping Oliver Gliese's net worth. Understanding the relationship between debt and net worth is essential for assessing an individual's overall financial health and well-being.

- Loans: Personal loans, student loans, and business loans can significantly impact net worth. High levels of debt can reduce disposable income, limit investment opportunities, and increase financial risk. Conversely, responsible borrowing can help finance education, business ventures, or major purchases, potentially contributing to long-term wealth accumulation.

- Mortgages: Mortgages, used to finance the purchase of real estate, represent a substantial financial obligation that can affect net worth. Homeownership can provide long-term stability and potential appreciation in value, contributing to net worth growth. However, excessive mortgage debt or a decline in property values can lead to financial strain and negative impacts on net worth.

- Credit cards: Credit cards offer convenience and flexibility but can also lead to debt problems if not managed responsibly. High credit card balances and interest charges can erode net worth and damage credit scores. Conversely, using credit cards wisely, paying off balances in full, and maintaining a good credit history can support a strong net worth.

Effective debt management involves balancing the responsible use of debt with the preservation of net worth. By understanding the implications of debt on financial well-being, individuals can make informed decisions about borrowing and credit usage, ultimately contributing to the growth and maintenance of a strong net worth.

Economic trends

Economic trends such as inflation, interest rates, and market volatility can have a significant impact on Oliver Gliese's net worth. Inflation, the rate at which prices for goods and services increase over time, can erode the purchasing power of his assets, reducing the real value of his net worth. Conversely, periods of low inflation can help preserve the value of his assets and potentially increase his net worth over time.

Interest rates, set by central banks, influence the cost of borrowing and lending. Higher interest rates can make it more expensive for Gliese to finance investments or purchase assets, potentially slowing down the growth of his net worth. On the other hand, lower interest rates can stimulate economic activity and investment, potentially benefiting his net worth.

Market volatility, referring to fluctuations in the prices of stocks, bonds, and other financial instruments, can also impact Gliese's net worth. During periods of high volatility, the value of his investments may experience significant upswings and downswings, potentially leading to gains or losses that affect his overall net worth.

Understanding the connection between economic trends and net worth is crucial for Gliese to make informed financial decisions. By monitoring economic indicators and assessing their potential impact, he can adjust his investment strategies, manage risk, and protect his net worth from adverse economic conditions.

FAQs on Oliver Gliese Net Worth

This section addresses common questions and misconceptions surrounding Oliver Gliese's net worth, providing concise and informative answers to enhance understanding.

Question 1: What factors contribute to Oliver Gliese's net worth?Gliese's net worth is influenced by various factors, including his income from astronomy-related work, investments in stocks and real estate, and financial milestones such as awards and grants.

Question 2: How does Gliese's investment strategy impact his net worth?Gliese's investment strategy plays a crucial role in shaping his net worth. By diversifying his investments across different asset classes, he seeks to manage risk and maximize returns, potentially contributing to the growth of his net worth.

Question 3: What is the significance of tax implications for Gliese's net worth?Tax implications, such as income tax and capital gains tax, can affect Gliese's net worth. Understanding these implications allows him to optimize his financial planning, reduce tax liability, and preserve his wealth.

Question 4: How does charitable giving influence Gliese's net worth?Charitable giving can impact Gliese's net worth by reducing his taxable income and providing tax benefits. It also aligns with his values and allows him to support causes he believes in, shaping his legacy beyond financial measures.

Question 5: What is the role of debt management in Gliese's net worth?Effective debt management is essential for maintaining a strong net worth. Responsible borrowing and credit usage can contribute to financial stability, while excessive debt can negatively impact net worth and overall well-being.

Question 6: How do economic trends affect Gliese's net worth?Economic trends, such as inflation, interest rates, and market volatility, can influence Gliese's net worth. Monitoring these trends and understanding their potential impact enables him to make informed financial decisions and protect his net worth from adverse economic conditions.

In summary, Oliver Gliese's net worth is a reflection of his financial well-being, shaped by various factors including income sources, investment strategies, tax implications, charitable giving, debt management, and economic trends. Understanding these factors and their interconnections provides a comprehensive view of Gliese's financial status and its implications for his overall financial security.

Transition to the next article section: This concludes the FAQs on Oliver Gliese's net worth. For further insights into his life and contributions to astronomy, please refer to the following sections.

Tips on Understanding Oliver Gliese Net Worth

Oliver Gliese's net worth is a measure of his financial well-being, encompassing his assets and liabilities. To fully grasp the significance and implications of his net worth, consider the following tips:

Tip 1: Examine Income SourcesIdentify Gliese's primary sources of income, such as salary, royalties from publications, and investment returns. Understanding these sources provides insight into how he generates wealth and the stability of his income streams.

Tip 2: Analyze Investment StrategiesGliese's investment strategy, including his allocation across stocks, bonds, and real estate, reveals his risk tolerance and financial goals. By examining his investment choices, you can assess his approach to wealth management and potential growth opportunities.

Tip 3: Consider Tax ImplicationsTax laws and regulations significantly impact Gliese's net worth. Understanding the tax implications of his income, investments, and charitable giving helps determine his after-tax wealth and financial planning strategies.

Tip 4: Evaluate Lifestyle ExpensesGliese's lifestyle expenses, including housing, transportation, and travel, influence his disposable income and savings potential. Analyzing these expenses can provide insights into his spending habits and their impact on his net worth.

Tip 5: Assess Debt ManagementGliese's debt management practices, such as loans and credit card usage, can affect his financial stability and net worth. By evaluating his debt levels and repayment strategies, you can determine his financial leverage and potential risks.

Understanding these tips empowers you to critically analyze Oliver Gliese's net worth and its implications for his overall financial well-being. By considering these factors, you gain a comprehensive perspective on his financial status and the strategies employed to achieve and maintain his wealth.

Transition to the article's conclusion: This concludes the tips on understanding Oliver Gliese's net worth. For further insights into his life, contributions to astronomy, and the significance of his financial status, please continue reading the following sections.

Conclusion

Oliver Gliese's net worth, as explored in this article, serves as a multifaceted indicator of his financial well-being and achievements. By examining his income sources, investment strategies, tax implications, lifestyle expenses, and debt management practices, we gain a comprehensive understanding of how he has accumulated and managed his wealth.

Gliese's net worth reflects not only his financial success but also his prudent decision-making and long-term planning. His contributions to astronomy, coupled with his sound financial management, have enabled him to establish a strong financial foundation that supports his ongoing research and legacy.

Understanding the intricacies of Oliver Gliese's net worth provides valuable insights into the financial aspects of a renowned scientist's life. It underscores the importance of financial literacy, strategic planning, and responsible wealth management for individuals seeking to achieve their financial goals and make a meaningful impact in their field.

Unveiling Roy Orbison Jr.'s Net Worth: Discoveries & Insights

Unveiling The Unsung Hero: Bobbi Mauney, Jb Mauney's Pillar Of Strength

Unveiling The Intriguing Connection: Are Katy Perry And Queen Elizabeth Related?

Oliver Gliese Bio, Age, Height, Boyfriend, Net Worth, Wiki

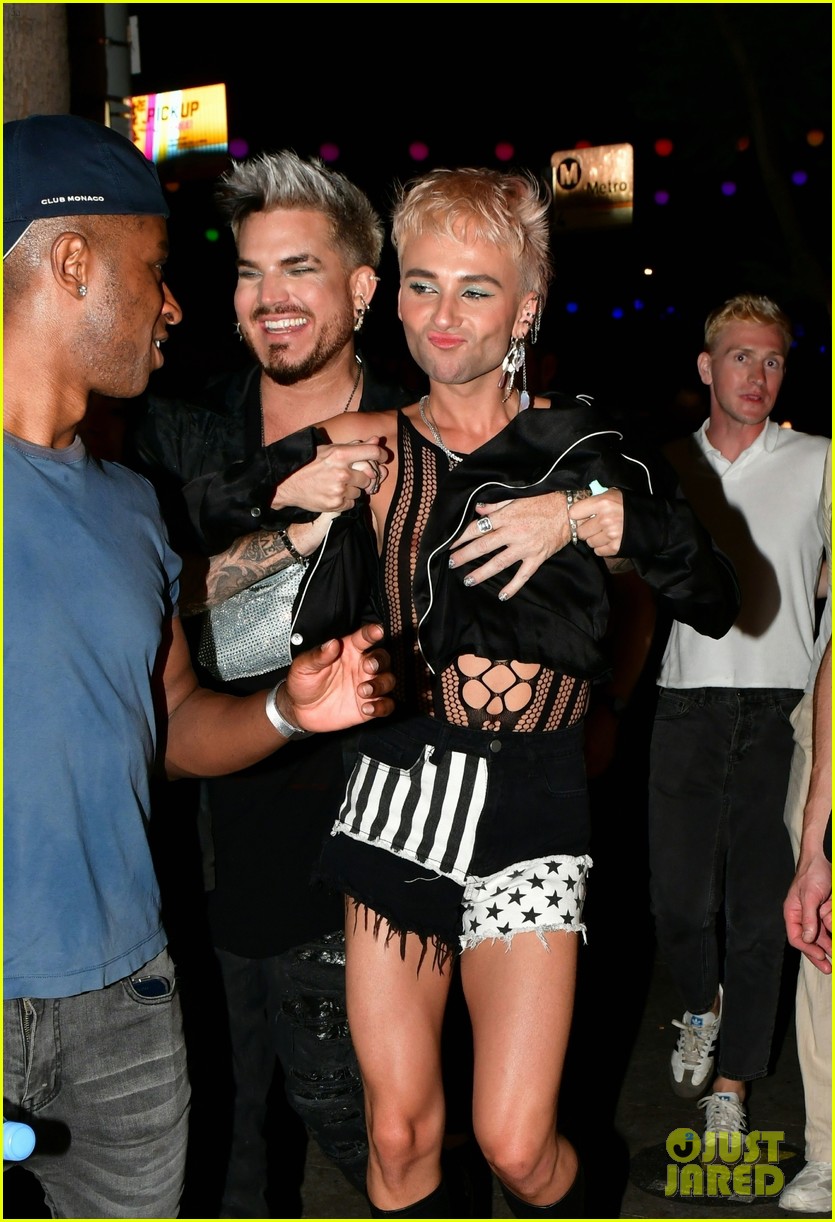

Adam Lambert & Boyfriend Oliver Gliese Hit the Town for Fun Night Out

ncG1vNJzZmillaCxsLqNmqSsa16Ztqi105qjqJuVlru0vMCcnKxmk6S6cLvLoq2eql2cuaqx0p5kp52kYsSwvtOhZaGsnaE%3D